We have some specific questions witch can help you on our FAQ, also you can always contact us with your specific question and our customer support will reply to you within 24 hours.

We hold your money with established Financial Institutions, so it’s separate from our own accounts and in our normal course of business not accessible to our partners.

We make sure your money’s secure, and that AYABANK is Financially stable. As we’re not holding your money with our bank, your money isn’t FSCS protected instead we safeguard it.

We’re regulated by authorities around the world. This includes the FCA in the UK and FinCEN in the US.

We use third party license and integrated financial services

We use 2-factor authentication to protect your account and transactions. That means you — and only you — can get to your money.

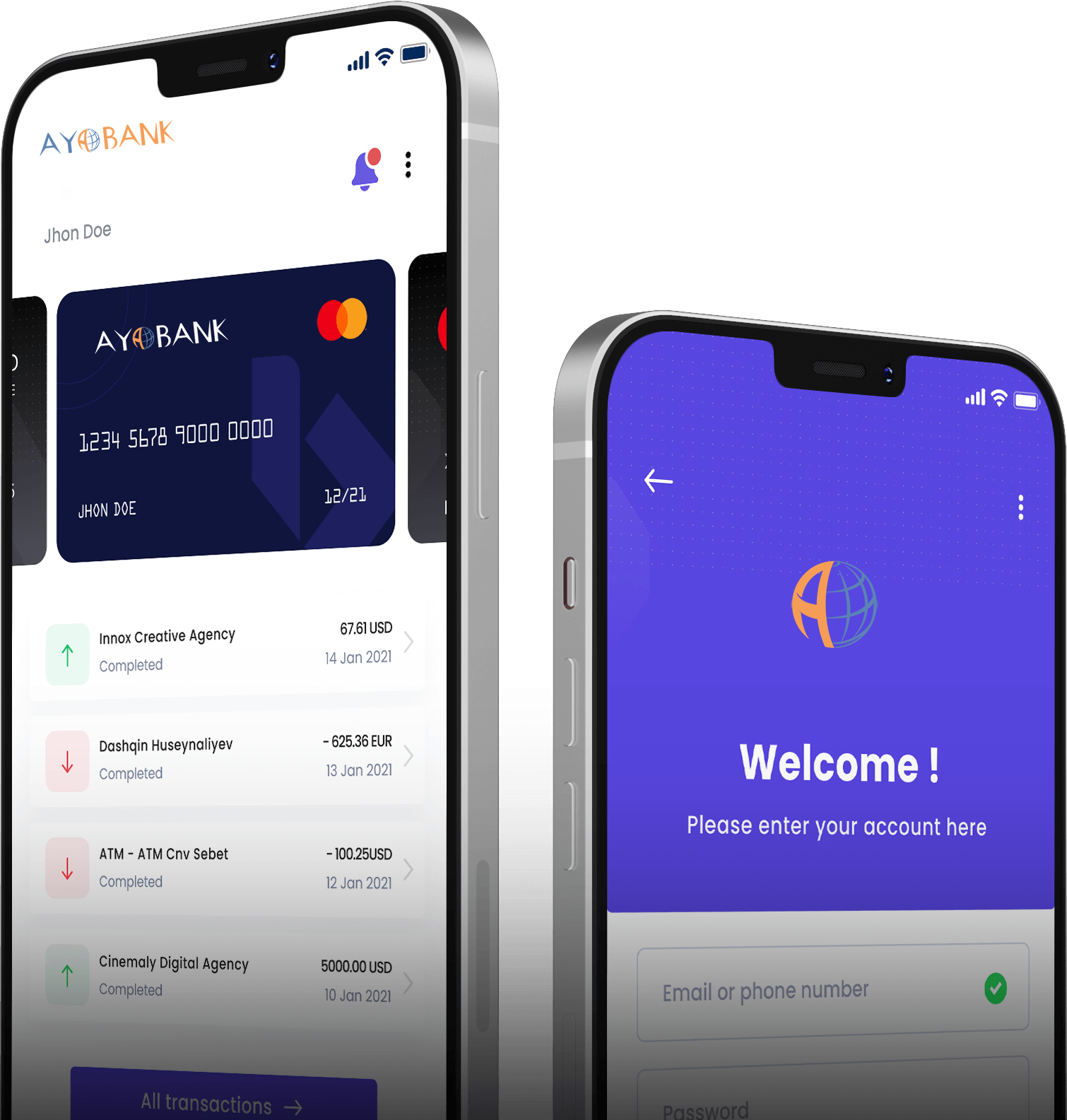

AYABANK Provides Virtual, Plastic & Metal Mastercard Cards for Personal and Business expenses.

Both types of cards – Virtual, Plastic and Metal – can be activated in your online profile.

Log in to your online profile, go to the “Cards” section, find the card you wish to activate and follow the instructions.

If you struggle, please see the detailed instructions below or contact our support.

For full card activation (to enable contactless payments), a Chip&PIN transaction is required (either ATM withdrawal or POS payment with a PIN).

For full card activation (to enable contactless payments), a Chip&PIN transaction is required (either ATM withdrawal or POS payment with a PIN).

The card can be funded after its activation.

The payment card has its own separate balance and should be topped up before any of the funds can be spent. It cannot be topped up by a transfer from another Financial Institution.

You can fund it from your AYABANK Business Account in seconds.

Our cards are designed to be fully managed through the AYABANK Online Platform.

You will be able to perform all the following actions:

If you have noticed a suspicious transaction on your card, first you should suspend/block your card to prevent further fraudulent use. Then you should contact AYABANK in order to proceed with the investigation.

You will receive a notification about the approaching card expiry date and will be advised to order a new card inside your online profile.

3DS is a security protocol that provides an extra layer of protection for payment card transactions.

It was created to allow a cardholder to authenticate their identity to prevent payment fraud and unauthorised transactions.

All AYABANK Cards are 3D Secure enrolled, meaning that you will sometimes be asked to verify online purchases with your 2FA verification code and a static password that the cardholder sets when ordering a card.

Our onboarding and account opening process is fully automated, however, real human support is available at any step.

To open Personal or Business Account each applicant has to proceed with online registration on our website at https://app.ayabank.us

The online registration form will take you around 5-10 minutes to complete and as soon as it is submitted, our Onboarding team will start the initial application review. If all the provided information is correct and sufficient, and no additional information from the client’s side is required, the account can be opened within a day.

We sincerely welcome any corporate clients registered across Britain, Europe and beyond.

Below you can see the full list of company jurisdictions currently accepted by AYABANK.

Please note there is some countries are restricted like Iran, ect..

With just a few steps and clicks you can join our bank and open an individual or corporate account with a lot of features and a professional financial services team.

AYAINVEST Limited. is registered in United Kingdom under company house under Reg# (11516853) Nature of business (SIC) 64191 – 64205 – 64301 – 66300.

AYA BANK is licensed in the United States of America from the State of Alaska under License No. 2136134.

Social Chat is free, download and try it now here!