Quicklinks

Menu

This Customer Agreement applies to our products and Services. It describes the rights and obligations of you and us and forms a legally binding contract between you and AYABANK when you register and use our services such as sending money to third party businesses or holding a balance with us.

IMPORTANT THINGS TO KNOW

These are known as ‘restricted activities’ and we tell you about them in our Restricted Activities. You must read this carefully to make sure you do not carry out any of these activities. If you do, we may stop you from using our Services.

1.1 This Business Customer Agreement is a contract between your Business (“you”) and AYAINVEST Limited (“AYAINVEST/us/we”) which defines the terms and conditions on which we provide our Services to you (the “Agreement”). Reference to ‘you’ includes a sole trader, freelancer, limited or public company, partnership, or a charity or trust.

1.2 This Agreement refers to and incorporates by reference additional documents (the “Additional Documents”), which also apply to your use of our Services, including:

1.3 By using our Services, you confirm that you accept and agree to this Agreement in its most current form as posted on our Website, App or by an API Partner. And you agree to pay all monthly fees and account setup fees, and any outstanding balance will be available under your account If you do not agree, you must not use our Services.

1.4 AYABANK may use third party for doing all the financial services, such Sending and Receiving funds. In those cases, your money will be held in accordance with the regulations and licences applicable to such entity.

1.5 Where there are any differences between this Agreement, the Additional Documents or information we provide on our Website, App or via an API Partner, the terms in this Agreement will take priority.

1.6 To receive some of our Services, such as our Assets products, you may be asked to agree to additional terms and conditions which we will tell you about before you use that service.

1.7 How this Agreement applies to you. If you only use our Services to make Money Transfers or maintain a profile with AYABANK without a AYABANK Account, then you agree to this Agreement each time you use our service in this way. When you open a AYABANK Account, this Agreement applies to that AYABANK Account whilst the AYABANK Account is open. AYABANK Account may opened and activated under third party financial services by using third party technology and API.

1.8 Future changes. We may update this Agreement from time to time as set out in ‘Our right to make changes.’ Any changes made to this Agreement will take effect as soon as the Agreement is on our Website and App or on the date notified to you. AYABANK not responsible of any notifications didn’t receive by clients, clients must always brows our website and check if there any updates.

1.9 You can always see the most current version of this Agreement on our Website. If you would like a copy of this Agreement, you can download it or contact Customer Support.

2.1 In this Agreement, capitalised words are defined in brackets within the Agreement or Additional Documents or have the meaning set out below:

3.1 We are AYAINVEST Limited, a company incorporated under the laws of England and Wales with company number 11516853.

3.2 Our registered office is Celtic Way Daventry Rail Freight Terminal, Northampton, United Kingdom, NN6 7GW, United Kingdom. This office is not publicly open to you or other members of the public, it’s a virtual office used for company house and can be changed from time to time.

3.3 AYABANK are authorized from DEPARTMENT OF COMMERCE, COMMUNITY, AND ECONOMIC DEVELOPMENT, State of Alaska under License No. 2136134. You can look us up on the Alaska Business License using our License reference number.

3.4 How to contact us. You can contact us by email, web chat or telephone by logging into your AYABANK Account or through our Help Centre.

USING OUR SERVICES

4.1 Overview. Each of our Services works slightly differently, here we provide an overview of the services covered by this Agreement and the terms that apply to all the Services under this Agreement. You should carefully read the section of the Service you intend to use:

4.2 High Risk Business Account. If you are a large corporation (that is, not a consumer, micro-enterprise or a charity, there three types of High-Risk Business Account in this Agreement will apply differently to you.

The notice period for AYABANK terminating this Agreement may be thirty (90) days, not two (2) months, and we can close your AYABANK Account for any reason regardless of whether that reason is listed in this Agreement.

5.1 Requirement. Your Business must be organized or registered in a country or territory that we support in order to use our Services.

5.2 One AYABANK Account, one profile. Your Business may only open one AYABANK Account and one profile unless we explicitly approve the opening of additional accounts. Where duplicate accounts are detected, AYABANK can close or merge these duplicate accounts without notifying you.

5.3 You must have authority to bind your Business. You must confirm that you in fact have authority to bind the Business on whose behalf you use our Services, and the Business accepts the terms of this Agreement. We may ask you at any time to provide proof of such authority. If you do not provide proof of authority that is acceptable to us, we may close or suspend the AYABANK Account or Services held by your Business or deny you access. This may be in favour of others who can provide proof of such authority.

5.4 Authorized Users. You can authorize others to access, use or operate a AYABANK Account or otherwise use our Services on behalf of a Business (but not by or on behalf of an individual) (an “authorized User”). You acknowledge that if you provide such access to an authorized User, we’ll deal with such authorized User as if they were you for the purposes of this Agreement including any conduct related to a balance held in the AYABANK Account or other instructions, such as withdrawing or sending money. You will be bound by anything done by any Authorized User, even if they do something that is outside the scope of the authority you gave them. You acknowledge that AYABANK will not perform any verification of the authority of your Authorized Users to act on behalf of your Business. You also acknowledge that we may disclose certain information about your profile or AYABANK Account to any Authorized User and that we are not responsible for your Authorized User’s use of that information. Granting permission to any Authorized User does not relieve you of your responsibilities under this Agreement, including notifying us if your AYABANK Account has been compromised or if a transaction is suspected to be incorrect or unauthorized.

5.5 Disputes with Authorized Users. Disputes between you and an Authorized User relating to your AYABANK Account or our Services are a matter between you and the Authorized User. You recognize that AYABANK is not a party to any claim or dispute between you and your Authorized Users. Because you are bound by the actions of Authorized Users, it’s very important that you choose Authorized Users carefully. We suggest you regularly reassess who can be an Authorized User and regularly review the activity undertaken by Authorized Users.

6.1 Using our Services. To start using our Services, you must create a profile and provide certain information about your Business as prompted by us.

6.2 Information must be accurate. All information you provide to us must be complete, accurate and truthful always. You must update this information whenever it changes. We cannot be responsible for any loss arising out of your failure to do so. We may ask you at any time to confirm the accuracy of your information and/or provide additional supporting documents.

6.3 Security and customer due diligence checks. We are required by law to conduct certain security and customer due diligence checks on you to provide any Services to you and allow you to have and maintain a AYABANK Account. Sometimes, we might also need to perform checks on other parties involved in a particular transaction (for example, on your recipient).

6.4 Information requests. You agree to comply with any request from us for further information and provide such information in a format acceptable to us. In addition, you agree that we may make, directly or through any third party, any inquiries we consider necessary to validate the information you provided to us, including checking commercial databases or credit reports. You authorize us to obtain one or more of your credit reports, from time to time, to establish, update, or renew your AYABANK Account with us or in the event of a dispute relating to this Agreement or our Services. You agree we may disclose certain information about your Business and Authorized Users, including relevant individuals’ names, residential addresses, and dates of birth to a credit reporting agency to obtain a credit report for these purposes.

6.5 AYABANK reserves the right to close, suspend, or limit access to your AYABANK Account or the Services in the event we are unable to obtain or verify any information related to you or your transaction.

6.6 AYABANK may offer additional features to enhance your AYABANK Account from time to time, such as connections to third party accounting software. We may stop offering those at any time without prior notice to you.

7.1 We recommend you use the Services to send money to trusted and verified businesses and third parties that are known to you or that you have already done business with. You should be cautious when sending money to the recipients you don’t know and have never dealt with before.

7.2 When accessing your AYABANK Account or profile, you should at the minimum do the following:

7.3 You must NOT:

7.4 Contact us if you suspect your AYABANK Account or profile has been compromised. If you suspect your AYABANK Account, profile or other login credentials are stolen, lost, used without your authorization, or otherwise compromised, you must contact Customer Support immediately. We recommend that you contact Customer Support right away. You can also freeze your Card with immediate effect on our App under the Account tab. You are also advised to change your password.

7.5 Any delays in notifying us of a compromised account, may affect the security of your account and result in losses that you would be responsible for. You must provide us with any reasonable assistance we require from you to investigate and take any action required to secure your account.

7.6 Extra Services you use may have additional security requirements and you must familiarise yourself with those.

7.7 You are responsible for ensuring that your information technology, computer programmes and platform is configured to access our Services. We cannot guarantee that our Services will be free from bugs or viruses.

7.8 If you have been subject to a scam. You may be eligible for reimbursement in the event of an Authorized Push Payment scam (“APP Scam”). To file a claim for an APP Scam:

7.9 Payments that are not eligible for filing a claim for an APP Scam include:

All transactions must also comply with our Acceptable Use Policy.

7.10 Reporting an APP Scam. If your payment is eligible as an APP Scam, you should report this to us and the police as soon as possible. This must be done within thirteen (13) months of the transaction. You can report multiple transactions related to the same APP Scam in one claim. We may ask for your permission to report the scam to the police on your behalf. If you do not give permission, it could affect your reimbursement eligibility.

7.11 Reimbursement Details. We will only reimburse eligible transactions from your claim. When your claim is closed, we will inform you of the transactions we can reimburse and any that are ineligible. The maximum amount we can reimburse you for an APP Scam claim is up to the value and excess as set and published by the Payment Systems Regulator from time to time.

7.12 Your APP Scam claim may be rejected for the following reasons:

If your APP Scam claim is rejected, we will explain the reasons in an email after closing your claim except where AYABANK may be prohibited by Applicable Law from providing an explanation.

8.1 Business purposes. You may only use our Services for business purposes. If you require a product or Service dedicated to your personal activities, you can apply for a personal AYABANK Account with AYABANK.

8.2 You must not misuse our systems. You must not misuse our systems by:

8.3 You must not misuse our Services. You must not misuse our Services by:

8.4 We may suspend your AYABANK Account or your access to our Services. We may suspend your profile or AYABANK Account, or restrict its functionality if we have reasonable concerns about:

8.5 We will give you notice of any suspension or restriction and the reasons for such suspension or restriction as soon as we can, either before the suspension or restriction is put in place, or soon after, unless notifying you would be unlawful or compromise our reasonable security measures.

8.6 The actions we may take if you misuse our Services or systems. If we believe that any of the activities listed in this section 8 have been taken by you, we may take several actions to protect AYABANK, its customers and others, at any time and at our sole discretion. The actions we may take include, but are not limited to, the following:

8.7 Court Orders. If we are notified of a court order or other legal process (including garnishment or any equivalent process) affecting you, or if we otherwise believe we are required to do so in order to comply with court order, applicable law or regulatory requirements, we may be required to take certain actions, including holding payments to/from your AYABANK Account, placing a reserve or limitation on your AYABANK Account, or releasing your funds. We will decide, in our sole discretion, which action is required of us. Unless the court order, applicable law, regulatory requirement, or other legal process requires otherwise, we will attempt to notify you of these actions using the contact information that you have provided to us. We do not have an obligation to contest or appeal any court order or legal process involving you, your AYABANK Account, or your use of our Services. When we implement a hold, reserve, or limitation because of a court order, applicable law, regulatory requirement or other legal process, the hold, reserve, or limitation may remain in place as long as reasonably necessary.

9.1 You may stop using AYABANK and/or close your AYABANK Account at any time. This Agreement continues until your AYABANK Account is terminated. You may close your AYABANK Account and/or end your ability to use our Services at any time by following the steps provided by us on our Website, App or via an API Partner.

9.2 If you want to close your AYABANK Account, you should withdraw your funds within a reasonable time. You must withdraw your funds before your AYABANK Account closes. At the time of closure, if you still have funds in your AYABANK Account, you will no longer have access to them, but you can still withdraw your money by contacting Customer Support. You have the right to do this for a period of 6 years from the date your AYABANK Account is closed.

9.3 Remaining funds may be subject to additional checks. After closure or deactivation of your AYABANK Account, you may be subject to additional checks before AYABANK is able to return the funds back to you.

9.4 When you may not close your AYABANK Account or delete your profile. You must not close your AYABANK Account or delete your profile to evade an investigation (either by AYABANK or an enforcement agency) or if you have a pending transaction or an open dispute or claim. If you attempt to do this, we may hold your money for a period that is reasonably necessary to protect our or a third party’s interest.

9.5 We may prevent your account from being closed or delete your profile if you have a negative balance or if your AYABANK Account is subject to a hold, limitation, or reserve.

9.6 You are responsible for your AYABANK Account after closure. You agree that you will continue to be responsible for all obligations related to your AYABANK Account and your use of our Services, even after it is closed, or you have stopped using our Services. For example, if you have a negative balance with AYABANK, you will remain responsible for paying us even after your AYABANK Account is closed and/or you have deleted your profile.

9.7 We may end this Agreement by giving you two (2) months’ notice. We may terminate this Agreement and close your AYABANK Account or any Services associated with it by giving you two (2) months’ prior notice, where required.

9.8 You cannot use the App if this Agreement ends. On termination for any reason all rights granted to you in connection with the App shall cease, you must immediately delete or remove the App from your devices.

10.1 Registering for AYABANK and/or opening a AYABANK Account may incur a charge. You may incur a fee when you use parts of our Services such as sending money, converting currencies, getting a card, or receiving wire payments.

10.2 You must pay our fees. We may not process your transaction(s) or provide any other Services to you until we have received the fees from you. Our fees do not include any fees that an API Partner, your bank, the recipient’s bank or other third party may separately charge.

10.3 You can see our fee structure on the Pricing page. The fees set out in our Pricing & Fees will be applicable to you when you use our Services and forms part of this Agreement. We may charge you a variable fee during periods of potential heightened volatility or unpredictability in the foreign exchange market, as determined by AYABANK. We will let you know if this fee is applicable when you set up your order. It is important that you read and agree to these fees before you use our Services. We may make changes to our fees as set out in “Our right to make changes”.

10.4 We can make deductions for amounts you owe us. You agree that we are Authorized to deduct our fees, any applicable Reversal amounts, or any amounts you owe us from your AYABANK Account, including negative AYABANK Account balances and funds held in a Jar. If you don’t have sufficient funds in your AYABANK Account to cover these amounts, we may refuse to execute pending or future transactions or provide any Services to you and may deduct funds sent to us for Services in the future.

10.5 Taxes. You are responsible for any taxes which may be due by you because of your use of our Services, and it is your responsibility to collect, report and pay the correct tax to the appropriate tax authority. We apply 20% tax for all our invoices and monthly fees.

10.6 API Partner fees. An API Partner may charge a fee for the convenience of using our Services via the API Partner. This fee is set by the API Partner and is separate to any fees charged by AYABANK for your transaction(s). AYABANK may collect this fee on behalf of an API Partner.

CONVERTING CURRENCY

11.1 Our Services include the ability to convert currencies, for example:

11.2 Exchange rate. When we refer to an exchange rate in this Agreement, it means the exchange rate at the relevant time for the relevant currency pair (for example, GBP to EUR, USD to AUD) that is offered by AYABANK, which is typically provided by a reference rate provider and usually the mid-market exchange rate. We may change our reference rate provider from time to time without notice to you.

11.3 For some currencies, we do not use the mid-market exchange rate, including where we are required by law to use a different reference rate for the exchange rate for your currency pair. For these currencies we will notify you of the exchange rate offered by AYABANK when you initiate a current conversion.

11.4 We may not process your currency conversion order until we hold or have received the funds and specified fees. It is your responsibility to ensure money that you fund a currency conversion order (whether through your AYABANK Account, as part of a Money Transfer or any other Service we provide) in a timely manner. We cannot be responsible for the time it takes for the money to be sent to us by your bank or payment service provider.

11.5 Refusing a currency conversion order. We reserve the right to refuse any currency conversion order if the conditions set out in this Agreement have not been met. Reasons for refusal may include but are not limited to incorrect information about a recipient, insufficient available funds, or where we believe you may have violated this Agreement, including where we believe you are or may be attempting to engage in currency trading or other trading for purposes not permitted by this Agreement. We will endeavour to notify you of any refusal, using the contact information that you have provided to us, stating (where possible) the reasons for such refusal, and explaining how to correct any errors. However, we will not notify you if such notification may be unlawful.

11.6 Confirmation of currency conversion order. Each currency conversion order is given a unique transaction number which is shown in the order confirmation and transaction history. You should quote this transaction number when communicating with us about a particular currency conversion order.

YOUR AYABANK ACCOUNT

12.1 About your AYABANK Account:

12.2 AYABANK is not a commercial Bank, and your AYABANK Account is not a bank account, your AYABANK Account it’s issued by third party Financial Institutions. The funds held with AYABANK, including balances in your AYABANK Account, are not insured by any deposit protection scheme, including the Financial Services Compensation Scheme (FSCS). AYABANK holds your funds in permissible investments in accordance with applicable laws. AYABANK owns the interest or other earnings on these investments, if any.

12.3 Account Details. When AYABANK provides you with Account Details (as described further below), these Account Details are a means to receive funds from third parties into a bank account held by AYABANK and its affiliates. AYABANK can credit your AYABANK Account when you use these Account Details, and they are not a bank account number for a bank account held by you.

12.4 How we protect your money. As AYABANK is not a commercial Bank, we use safeguarding to protect your money. This is done in accordance with the regulations 17 of the PSR. AYABANK keeps your money in the name of AYABANK in established financial institutions. Your money is deposited in Great British Pounds (GBP) into dedicated and segregated accounts held by us with our safeguarding institutions. We may change our safeguarding institutions from time to time, without notice to you. You can find out more about how we safeguard your money in the Safeguard Help Centre.

12.5 Adding money to your AYABANK Account. To add funds to your AYABANK Account, you need to log in to your AYABANK Account and follow the steps. You may be presented with one or more methods of adding funds to your AYABANK Account. For example, you may be able to use a bank transfer, authorise AYABANK to debit the money from your bank or payment account with a third party, or use a credit card or debit card (in this Agreement, we will call these methods “Pay-in Methods”). Any Pay-In Method that you use to add money to your AYABANK Account must be in your name.

12.6 Funding your Money Transfer and AYABANK Account with Direct Debit. If you choose to pay for a Money Transfer or to add funds to your AYABANK Account by using the Direct Debit feature (including BACs), you will need to provide your bank login details or bank account details to us, including your bank account number and routing number. When you choose to pay using Direct Debit and provide your details, you confirm that your details are correct, that you are Authorized to access and transmit funds from your bank account, that your bank account is in good standing with the account-holding financial institution, and that you have the authority to initiate an electronic funds transfer in the amount at issue to or from your bank account.

12.7 Pay-in Methods. The Pay-in Methods made available to you will depend on a few factors including where you live and your verification status with us. You will see the available Pay-in Method when you choose to add funds to your AYABANK Account. We cannot guarantee the availability of any particular Pay-in Method and we may change or stop offering a Pay-in Method at any time without notice to you.

12.8 Adding money with your debit or credit card. Where you can use a debit or credit card as your Pay-in Method to add money to your AYABANK Account, you will need to provide your card details to us. This will include your card number and cardholder name. When you choose to add money via debit or credit card, you confirm that your card details are correct, that you are Authorized to access and transmit funds from your card account, that your card account is in good standing with the account provider and that you have the authority to initiate a debit or credit card payment in the amount at issue from your card account. You will need to pay any fees incurred from adding money by using your debit or credit card.

12.9 Chargebacks on your Pay-in Method. If you select a Pay-in Method which can be subject to chargeback (for example a credit card), you agree that you will only exercise this chargeback right if:

12.10 Restrictions on adding Money. We only offer the Pay-In Methods you see when you access our Services. Other methods, such as a paper or e-cheque, and cash will not be accepted. For legal, security, or other reasons, there may be financial limits on your chosen Pay-in Methods or currencies, including how much you can add to your AYABANK Account. We will let you know at the time of adding money if there is a limit.

12.11 Receiving money to your AYABANK Account. Where available, and in certain currencies, you may request to receive money from a third party (“Request Money“) or we may provide you with local account details that you or a third party can use to send money directly to your AYABANK Account (“Account Details”). The Account Details that we provide to you are only a means to receive funds from third parties into a bank account held by AYABANK and its affiliates, so that AYABANK can credit your AYABANK Account that is held at the AYABANK entity described in the beginning of this Agreement (regardless of currency) and are not a bank account number for a bank account held by you.

12.12 We may carry out verification checks when you request Account Details in addition to the checks required to obtain a AYABANK Account, and we may carry out further checks on an ad-hoc basis. From time to time your Account Details may change. When this occurs, we will notify you, and you are responsible for updating third parties and other arrangements you may have to receive funds using your Account Details. AYABANK is not responsible for issues that arise when Account Details are changed, and it is your responsibility to notify third parties that your Account Details have changed.

12.13 Using Request Money to receive money. You can use the Request Money feature of your AYABANK Account when requesting a payment from a third party. The Request Money feature allows a third party to send you money via a number of available methods including Card, their AYABANK Account, bank transfer and open banking. When using open banking, your AYABANK account details and requested amount are pre-populated for the third party. AYABANK is not responsible for issues that arise when changes are made by the third-party to the pre-populated details including the requested amount.

12.14 When money received is shown in your AYABANK Account. Any money you receive into your AYABANK Account will be converted into electronic money and recorded in your transaction history. You should check and confirm the receipt of incoming funds in your AYABANK Account regularly and let us know if there are any irregularities or discrepancies.

12.15 When we will credit your AYABANK Account. We are not responsible for the funds you have added until we have received them. For clarity, when you add funds to your AYABANK Account, we are the recipient of those funds. This means the bank or payment service provider you used to send the funds to us is the one responsible for making sure we receive them so that we can credit them to your AYABANK Account.

12.16 We will credit your AYABANK Account once we have received your funds. For some Pay-in Methods such as a credit or debit card, we may credit the funds before we receive the funds subject to our right of Reversal. This means if we credit your AYABANK Account for the full amount you intended to add but this amount does not reach us, we will deduct that amount from your AYABANK Account. If you have already spent the funds, this could make your AYABANK Account have a negative balance (see “What happens if you owe us money”).

13.1 You can request to withdraw your funds. You may withdraw all or some of the balance in your AYABANK Account. We may charge you a fee for each withdrawal request, we will let you know the exact amount when you submit your request. You can also find out more information about the fees we charge on the Pricing & Fees.

13.2 Pay-out Methods available to you. You may be presented with one or more methods of withdrawal (in this Agreement, we will call these methods “Pay-out Methods“). The number of Pay-out Methods made available to you will depend on a few factors including where you live and your verification status with us. We cannot guarantee the use of any Pay-out Method and may change or stop offering a Pay-out Method at any time without notice to you.

13.3 You must provide correct information to us. When setting up your withdrawal request, you must ensure that the information you provide is correct and complete. We will not be responsible for money sent to the wrong recipient because of incorrect information provided by you.

13.4 What happens if you provide incorrect recipient information. If you have provided incorrect information to us, we may, but are not required to, assist you in recovering your funds. We cannot guarantee that such efforts will be successful as they rely on the policies and practices of other banks and institutions. In addition, AYABANK may not be able to confirm that your recipient’s name and account number match, as the names and other information associated with third party accounts may not be known to AYABANK. This means that if you provide an incorrect account number, your funds will most likely go to the wrong account.

13.5 Your withdrawal request is subject to limits. You agree that your AYABANK Account is subject to withdrawal limits. If your withdrawal request exceeds the current limit, we may decline your request or we may require you to provide additional documents to us so that we can carry out additional checks before allowing the money to be withdrawn.

13.6 Delay in withdrawal. We may delay a withdrawal in certain situations, including if we need to confirm that the withdrawal has been Authorized, to complete verification checks, or if other payments to your AYABANK Account have been reversed (for example, because of a chargeback or Reversal). We cannot be held responsible for any such delays, provided that we have acted reasonably in delaying a withdrawal.

13.7 Finality. Pay-outs, currency conversions and Card or other transactions executed by us are final and irrevocable once you request them, unless otherwise provided in this Agreement or pursuant to applicable law.

14.1 Funds added or received to your AYABANK Account may be subject to Reversal or chargeback. Funds added to your AYABANK Account or received amounts to fund your Money Transfers could be Reversed or subject to a chargeback, which means that you will not get those funds credited to your AYABANK Account or to your Money Transfer. A Reversal or chargeback may occur where the funds added to your AYABANK Account or to your Money Transfer are Reversed by AYABANK or Reversed to or subject to a chargeback by the person paying you the money or the payment provider.

14.2 When a Reversal or chargeback may happen. You may be liable for and/or have funds reversed or be subject to a chargeback when, without limitation, we have reason to believe:

14.3 If any funds are Reversed by the sender or any payment provider, you agree that AYABANK may refund, deduct, or reverse the amount of the funds plus any fees from your AYABANK Account (if applicable) in the same currency as the original transaction. If your AYABANK Account balance for the relevant currency is insufficient to cover the amount of a refund or Reversal, AYABANK may at its discretion perform a currency conversion to refund or reverse the transaction, subject to the exchange rate being offered by AYABANK in the applicable currencies at that time. If a Reversal or chargeback causes you to have a negative balance, you will be immediately liable to AYABANK for the negative balance plus any losses to AYABANK, if any.

14.4 Chargeback Fees. If you receive a debit or credit card-funded payment into your AYABANK Account and you (or a third party) pursue a chargeback for the transaction with the card issuer, then AYABANK may apply a fee in accordance with our Pricing Page, for facilitating the chargeback process and will remove the chargeback funds from your AYABANK Account, including funds held in a Jar.

15.1 Transaction history is displayed on your AYABANK Account. All your transactions (including your current balance, funds you have added, received, sent and/or withdrawn), related fees and exchange rates, if applicable, are recorded in the statement section of your AYABANK Account.

15.2 Statements. You have the right to request a physical account statement showing your AYABANK Account activity by contacting Customer Support. You may view your AYABANK Account statement by logging into your AYABANK Account. You may be able to view your AYABANK Account in a way that some of your transactions are hidden. This is to allow you to isolate transactions from recipients to determine your spending with those recipients. You will need to readjust your viewing preferences if you have used this feature to default to see all transactions.

15.3 Check your AYABANK Account regularly. You must check your AYABANK Account regularly and carefully and contact our Customer Support team immediately if you don’t recognise a transaction or think we have made a payment incorrectly. You must tell us about any unauthorized or incorrectly executed transactions immediately and no later than thirteen (13) months after the transaction date from when you become aware of the unauthorized transaction.

15.4 You accept the risks of holding funds in multiple currencies. You agree and accept all the risks associated with maintaining an account that can hold balances in multiple currencies including any risks associated with fluctuations in the relevant exchange rates over time.

15.5 Auto Conversion. For certain currencies, you may be able to set one or more conversion orders to be automatically executed once the exchange rate you pick is offered by our Services (an “auto conversion order”). There may be limits to the number of auto conversion orders you are able to set up, as well as the amounts of money you can schedule to convert. AYABANK does not guarantee that it will be able to execute your auto conversion order in all circumstances.

15.6 We are not a currency trading platform. AYABANK is not a currency trading platform. You agree that you will not use your AYABANK Account for seeking to profit from currency conversion or foreign exchange trading or other types of speculative trading, or for speculative trading purposes, conversion arbitrage, conversion options or any other activity that AYABANK determines is primarily for the purpose of gaining or making gains based on currency conversion rates.

15.7 Accordingly, you should not use our Services, including the AYABANK Account or the auto conversion order function for this purpose, including creating multiple auto conversion orders or a series of Money Transfers without the intention of completing them. If we detect that you are using our Services for this purpose, we may, at our sole discretion, set a limit on the number of auto conversion orders you may create, cancel your orders, set a limit on the amount of money you can convert or transfer in one or more currencies or in the same currency, restrict your ability to access certain features or use our Services, or suspend or close your AYABANK Account. AYABANK may also hold, cancel, or reverse any transaction we determine to violate this policy and disgorge your gains.

15.8 Negative Balances. You promise to always have a zero or positive balance in your AYABANK Account and to repay AYABANK if your AYABANK Account balance is negative, including because of a chargeback, Reversal, deduction of fees, any other error, or any other action. That negative amount represents an amount you owe to AYABANK, and you must repay the negative amount immediately without any notice from us. We may send you reminders or take other actions to recover the negative amount from you, for example, we may use a debt collection service or take further legal actions. We may charge you for any costs we may incur as a result of these collection efforts. There are for any outstanding balance, late payments, monthly fees or any other negative balance daily penalty 5%. We always required minimum balance deposit funds available in your account to recovery any negative balance. For more information, see “What Happens if you owe us money”.

16.1 What is a Jar? A “Jar” is a sub account within the AYABANK Account that can be used to segregate a portion of your funds. You may use jars to keep funds for a designated purpose in the future, such as paying invoices or to assist with your budgeting. You can only put funds into your Jar by transferring money from your AYABANK Account. You cannot use the funds directly from a Jar to make payments. To use the funds held in a Jar you must transfer the funds out of the Jar back into your AYABANK Account balance. You should keep enough unrestricted money in your AYABANK Account to cover all anticipated fees. AYABANK is not responsible for fees resulting from unfunded transactions due to funds being in a Jar.

16.2 Jars are not savings accounts, do not have their own account numbers, and don’t earn interest. Money held in your Jars does not earn any interest and is not insured by any deposit protection scheme, including the FSCS.

17.1 Direct Debit. You can set up a Direct Debit to allow someone else (the payee) to take money from your AYABANK Account. This is an agreement between you and a third party, and you may agree to allow such automatic withdrawal on a recurring or sporadic basis. Examples of automatic payments that can be arranged by you, but are not limited to, include those that may be called a “billing agreement,” “subscription,” “recurring payment,” “reference transaction,” “preauthorized transfer” or “preapproved payment.”

17.2 Direct Debit Refunds. Direct Debits must be cancelled at least one (1) business day before they are due; otherwise, the Direct Debit might still go through. Direct Debits are collected from your AYABANK Account based on consent you have given in the past. Businesses are expected to tell you the amount of any merchant-initiated payment before they collect it. However, if you think a Direct Debit has been taken from your AYABANK Account in error, you can ask us to refund it within eight (8) weeks of it being paid. To request a refund, contact us and we will let you know if your refund is successful within ten (10) business days.

17.3 Once your Direct Debit is cancelled on your AYABANK Account, all future automatic payments under your agreement with that third party will be stopped. If you cancel a Direct Debit, you may still owe a third party for any goods or services that you receive but have not paid for.

17.4 If you have given advance authorisation, either to a third party or to AYABANK, that permits the third party to take or receive payments from your AYABANK Account on a recurring basis (for example, every month or otherwise on a routine cycle), and if such payments will vary in amount, you have the right to receive advance notice of the amount and date of the Direct Debit from the third party, typically three (3) days before the Direct Debit is made. If the third party provides the option, you may choose to receive this advance notice only when the amount of your automatic payment will fall outside a range established between you and the third party.

17.5 If you have Authorized a Direct Debit and AYABANK performs a currency conversion for an automatic Direct Debit, AYABANK will use the exchange rate offered at the time the transaction is processed.

18.1 Cards. Your Card can be used to access and spend the funds in your AYABANK Account, for example, to pay for goods and services online, over the phone, or in person and can be used to withdraw money from ATMs. The Card is not a guarantee card, charge card or credit card. It is not for resale. The Card may be cancelled, repossessed, or revoked at any time without prior notice subject to applicable law.

18.2 Digital card. You may apply for a digital Card as well as a physical Card. Your digital Card will have a different set of card details from your physical Card, but will draw from the funds in your AYABANK Account in the same manner as your physical Card. Your digital Card is activated instantly once those details are provided to you and can be used right away. You can freeze your digital Card at any time and unfreeze it once you are ready to use it again.

18.3 Cards and FSCS. The UK Financial Services Compensation Scheme does not apply as your Card is linked to your AYABANK Account, which is an electronic money account and not a bank account. The Financial Services Compensation Scheme does not apply to your AYABANK Account or Card.

18.4 Verification. We may carry out verification checks when you request a Card in addition to the checks required to obtain a AYABANK Account, and we may carry out further checks on an ad-hoc basis. These checks may increase the time it takes to process your order for a Card. We are not responsible for any delays because of carrying out those checks. If you have paid a fee for your Card but we decide you do not meet our verification requirements, we will cancel your Card and refund the fee you paid for your Card within fourteen (14) days of our decision. We may not refund the fee in certain circumstances.

18.5 How to activate your Card. When you receive your Card, please sign the back of it as soon as you receive it and keep it safe. The Card PIN is a 4-digit code that you may be asked to enter when making a payment using the Card.

18.6 You must not make purchases or withdraw funds with your Card that exceed the amount of funds available in your AYABANK Account. If any purchase or withdrawal takes you over your available funds or the card limits indicated by AYABANK the transaction will be declined.

18.7 Spending limits. While we may offer you the ability to set spending limits, we reserve the right to add, increase, or decrease spending limits on your Card from time to time. This is in our sole discretion without notice to you except as required by law, for security or other reasons.

18.8 Other limits. We may, at our reasonable discretion, decline the use of your Card for situations including, but not limited to:

18.9 When can we suspend or cancel your Card. Along with closing or suspending your AYABANK Account, we can suspend or cancel your Card, including if (i) the activity on your Card or AYABANK Account appears suspicious, fraudulent or may be associated with criminal activity or activity which is inconsistent with this Agreement; (ii) there is suspicious or fraudulent activity associated with a personal AYABANK Account which is affiliated with your AYABANK Account; or (iii) we believe your AYABANK Business and/or an affiliated personal AYABANK account may be associated with criminal activity or activity which is contrary to this Agreement. Unusual or multiple purchases may prompt a merchant inquiry or Card suspension to allow us to investigate such activity.

18.10 We reserve the right, in our sole discretion, to limit your use of the Card. We may refuse to issue or replace a Card or may revoke Card privileges, other than as required by applicable law. You agree not to use or allow others to use an expired, revoked, cancelled, suspended or otherwise invalid Card. We will not incur liability to you because of the unavailability of the funds that may be associated with your Card or AYABANK Account.

18.11 Replacement of card. If you need to replace your Card for any reason, please follow the instructions on our Website or App or contact Customer Support. We will charge a fee for the replacement Card.

19.1 You authorise every transaction. You agree that any use by you of your Card, card number or PIN constitutes your authorisation and consent to the transaction.

19.2 Employee cards are business cards. Where there are multiple cardholders within the same AYABANK Account, including Authorized Users, any transaction Authorized by any one of the cardholders is deemed to be effectively Authorized by you.

19.3 Card transaction fees. You agree to pay the Card transaction fees set forth in the Cards. All the Card transaction fees will be withdrawn from your AYABANK Account and will be assessed if there are funds remaining on your AYABANK Account. If at any time your remaining funds are less than the Card transaction fees being assessed, the funds in your AYABANK Account will be applied to the Card transaction fees resulting in a zero amount on your AYABANK Account, and your Card may be declined. The remainder of the Card transaction fees due will be collected the next time you add funds to your AYABANK Account.

19.4 Priority of currencies and currency conversion when you use your Card. If you withdraw cash or make a purchase in a currency for which you hold a balance in your AYABANK Account, AYABANK will use that currency for your withdrawal or purchase, and you consent to and authorise AYABANK to convert the currency in place of your Card network.

19.5 In a currency that you do not hold in your AYABANK Account. If you withdraw cash or make a purchase in a currency for which you do not hold in your AYABANK Account, or if you withdraw cash or make a purchase in a currency in an amount that exceeds the available funds that you hold in that currency, AYABANK may convert funds from another currency that you hold in your AYABANK Account to cover that transaction, and AYABANK currency conversion fees will apply. You cannot set a default or preferred currency to convert from.

19.6 When determining which currency to convert where you have more than one currency in your AYABANK Account, AYABANK will use the currency with the lowest conversion fee for the currency needed to complete the cash withdrawal or purchase made by you. In cases where the conversion from several currencies will have the same conversion fee, we will convert based on the highest conversion rate. For more information on which currencies would be used in the event that you use your Card to withdraw cash or make a purchase in a currency that you do not hold in your AYABANK Account, please check the AYABANK Cards & Fees or contact Customer Support.

19.7 In a currency that is not supported by AYABANK. If you withdraw cash or make a purchase in a foreign currency that is not supported by AYABANK, the rate charged by the VISA/MASTERCARD® network shall apply.

19.8 Please note that if you are offered the option at a point of sale (POS) terminal to pay in local currency or to pay in your home or another currency, you must pick the local currency if you want the AYABANK rate to apply to your transaction.

19.9 Returns and Refunds. If you are entitled to a refund for any reason for goods or services obtained with your Card, you agree to accept credits to your AYABANK Account for such refunds and agree to the refund policy of that merchant. Merchant refunds will be provided to AYABANK for crediting to your AYABANK Account when they are received. AYABANK has no control over when a merchant sends a refund transaction; there may be a delay between the date of the refund transaction and the date the refund amount is credited into your AYABANK Account and refunds from merchants may be in an amount the same or less than the amount of the corresponding debit.

19.10 Refunds in different currencies. If you receive a refund on a Card payment in a currency for which you have a balance, we will credit said balance. If you receive a refund in a currency that you do not hold a balance or if you receive a refund in a currency we do not support, we will credit your AYABANK Account in the card’s default currency, which may require us to convert the currency.

19.11 Unjust enrichment. In case you notice a refund has been received twice for the same transaction, for example in both your AYABANK Account and from a merchant, you are required immediately to let us know, and we always reserve the right to debit back a previously issued refund when a refund for the same transaction has been provided by the merchant as well, without prior notice.

19.12 No Warranty Regarding Goods or Services as Applicable. AYABANK is not responsible for the quality, safety, legality, or any other aspect of any goods or services you purchase with your Card. Any disputes or issues with any goods or services you purchase with your Card should be addressed to the merchants or individuals from whom the goods and services were purchased.

19.13 Disputed transactions. In case of disputed Card transactions, we may, subject to any restrictions under applicable law, decide not to proceed with Chargebacks at our sole discretion. Reasons for this might include:

20.1 Your Card has an expiry date. You can only use your Card up until the expiry date which will be shown on the back of your Card and/or in the App.

20.2 We’ll aim to notify you two (2) months before your current Card will expire. You then may order a new Card by following the instructions on our Website or App. A replacement Card fee may apply.

20.3 If you do not want your Card to be renewed, you can simply let it expire without ordering a replacement. Your Card will be deactivated, and you will not be able to use it after its expiry. You should destroy your expired Card.

21.1 Keep your Card safe. Other than an Authorized User, never let another person or third party use your Card and keep it safe. Memorise your PIN and never disclose this and other security information to anyone. Sharing these details can lead to unauthorized access to your AYABANK Account and you will be solely responsible for transaction(s) made in this situation. AYABANK will not be liable for any loss arising due to any such unauthorized transaction(s).

21.2 Report any suspicious incidents. If your Card is lost or stolen, you suspect that someone else knows your PIN, or if you think your Card, card number or PIN may be misused, you agree that you must stop using the Card, and immediately freeze or replace the Card. If this happens, we recommend that you both call and email Customer Support right away. You can also freeze your Card with immediate effect on our App under the Account tab. If you find the Card after you have reported it lost, stolen, or misused, you must destroy it and tell us as soon as you find it.

21.3 Disclosure of information to law enforcement authorities. If your Card is used without your permission, or is lost, stolen or if you suspect the Card may be misused, we may disclose to law enforcement agencies any information which we reasonably believe may be relevant.

22.1 Cancelling your Card. You may cancel your Card at any time with no charge by logging into your AYABANK Account or through the App.

22.2 We have the right to cancel your Card. Note that subject to any restrictions under applicable law, we reserve the right to cancel or suspend your Card at any time for any reason. Use of your Card is subject to all applicable rules and customs of any clearinghouse or other association involved in transactions.

MONEY TRANSFERS

23.1 Information you need to provide to set up a Money Transfer. To set up a Money Transfer, you will need to provide certain information to us, including, but not limited to, the full name of your recipient, your recipient’s bank account details (e.g. sort code and account number for UK accounts or the International Bank Account Number (IBAN) for payments made to non-UK accounts) or their AYABANK Account information and the amount and currency that you are sending.

23.2 You will need to sign into your AYABANK Account using all relevant passwords and prompts to carry out a Money Transfer transaction. We will view your use of all relevant passwords and prompts as the giving of your consent to us to make a Money Transfer.

23.3 Payment order limits. We may place limits on the amount you may send per Money Transfer. You can see more information in the Help Centre. Remember. When you use our Money Transfer services you might be doing business with another AYABANK entity depending on the currency you are sending. You will be subject to that entity’s customer agreement for that Money Transfer.

24.1 How to pay for your Money Transfer. To pay for your Money Transfer, you need to access your AYABANK Account or profile, by logging in on our Website or App or via an API Partner, and follow the steps provided.

24.2 Payment methods. You may be presented with one or more methods of paying for a Money Transfer (for example, a bank transfer, a credit or debit card or a AYABANK Account balance). The number of payment methods made available to you will depend on a few factors including where you live and your verification status with us. We cannot guarantee the availability of a particular payment method and we may change or stop offering a payment method at any time without notice to you.

24.3 Payment instruments must be in your name. Any payment instrument (for example, the credit card or debit card or bank account from which you make a transfer) you use to pay for a Money Transfer must be in your name.

24.4 Paying with your debit or credit card. Where you can pay for a Money Transfer using your debit or credit card, you will need to provide your card details to us, including your card number and cardholder name. When you choose to pay with a debit or credit card, you confirm that your card details are correct, that you are Authorized to access and transmit funds from your card account, that your card account is in good standing with the account-holding financial institution, and that you have the authority to initiate a debit or credit card payment in the amount at issue to or from your card account. You authorise us to initiate credits and debits to your bank account through card payment networks to process your transaction, including any applicable fees and charges, and this authorisation shall remain in effect so long as you are able to use our Services, unless cancelled in accordance with this Agreement.

24.5 You need to provide us with sufficient funds, after you set up your Money Transfer, before we can process it. We are not responsible for the funds you have sent us until we have actually received them. We may only process your Money Transfer if we hold or have received sufficient cleared funds in accordance with this Agreement and the instructions provided. If you send us funds before finalising a Money Transfer order, those funds will either be placed into your AYABANK Account, or, if you do not have one, we will attempt to return them to you. It is your responsibility to fund your Money Transfer in a timely manner. We cannot be responsible for the time it takes for the money to be sent to us by your or a third party’s bank or payment service provider.

25.1 When we will complete your Money Transfer. We will complete your Money Transfer once we have received your funds. For some payment methods such as a credit or debit card, we may send your Money Transfer as soon as possible.

25.2 Guaranteed rates. We may provide you with a guaranteed foreign exchange rate for a period. We will notify you of the guaranteed rate and the period during which we are offering that rate (the “Guaranteed Period”) when you create your Money Transfer.

25.3 Guaranteed Periods are subject to the following conditions:

25.4 The AYABANK exchange rates. We will confirm the available exchange rate (if applicable) for your Money Transfer:

25.5 Chargebacks on your payment instrument. If you selected a payment method which can be subject to chargeback (for example a credit card), you agree that you will only exercise this chargeback right if:

25.6 You agree that you will not exercise your chargeback right for any other reason, including a dispute with a recipient. If we need to investigate or take any actions in connection with a chargeback caused by or related to you, we may charge you for our costs in doing so and may deduct those costs from your AYABANK Account (if you have one) or limit or remove your access to our Services. See What happens if you owe us money.

25.7 When we receive your request. If your Money Transfer request is received by us after 5pm UK time on a Business Day or on a day that is not a Business Day (e.g., a weekend or bank holiday), your Money Transfer will be deemed received on the following Business Day.

25.8 What happens after you have submitted your Money Transfer request. Once we have received your Money Transfer request, we will provide you with a unique transaction number which you can find in your AYABANK Account or profile. You should quote this number when communicating with us about a particular Money Transfer or other transaction.

25.9 Sending money using an email address. If you send money to a person using an email address which is not registered with us, the money will not be credited until the intended recipient has claimed the money by following the steps set out for them in an email that they will receive. Until that process is successfully completed, there is no relationship between us and the intended recipient and the money continues to belong to you. We will refund the money to you if the intended recipient does not claim the money or if they have failed our recipient checks within a reasonable period as determined by us.

25.10 Delay in transfer. We may delay processing a Money Transfer in certain situations, including if we need to confirm that the transaction has been Authorized by you, because of verification checks or due diligence reviews, or if other payments to your AYABANK Account have been reversed (for example, because of a Chargeback or Reversal). AYABANK is not responsible for such delays, where we have acted reasonably.

25.11 Completion time of your Money Transfer. The estimated completion time of your Money Transfer will be provided to you when setting up your Money Transfer.

25.12 We will use reasonable efforts to ensure funds arrive at your recipient’s account within the timeframe provided. We will use reasonable efforts to ensure that the funds arrive in the recipient’s bank account or payment account within the notified timeframe provided to you. We do not have any control over the time it may take for the recipient’s bank or payment provider to credit and make available funds to the recipient.

25.13 Refusal of your Money Transfer. If we are unable to complete your Money Transfer, we will let you know and, when possible, the reasons for the refusal and an explanation of how to correct any factual errors. However, we are not required to notify you if such notification would be unlawful.

25.14 You may cancel your Money Transfer before your funds are converted. You may cancel your Money Transfer by following the instructions set out in our Help Centre. You cannot cancel your Money Transfer once your funds have been converted and transfer initiated.

25.15 When will I be notified of my scheduled Money transfer? If you have scheduled a Money transfer in advance then we will notify you 24 hours before your upcoming Money Transfer, setting out the total fees and the estimated exchange rate for that Money Transfer. By scheduling a Money Transfer, you agree to AYABANK sending the funds using the exchange rate at any time on the scheduled date. If you have opted in to receiving confirmation emails, we will send you a Money Transfer receipt after successfully sending your scheduled Money Transfer.

25.16 You must ensure the information you provide to us is correct. You must make sure that the information you provide when setting up a Money Transfer is accurate. If we have processed your order in accordance with the information you have provided to us it will be considered correctly completed even if you have made a mistake.

25.17 What happens if you provide us with incorrect information? If you have provided incorrect information to us, we may, but are not required to, assist you in recovering your funds. We cannot guarantee that such efforts will be successful as they rely on the policies and practices of other banks and institutions. In addition, AYABANK may not be able to confirm that your recipient’s name and account number match, as the names and other information associated with third party accounts may not be known to AYABANK. This means that if you provide an incorrect account number, your funds will most likely go to the wrong account.

25.18 Finality. When you make a Money Transfer, the settlement and payout to the recipient are final and irrevocable unless otherwise provided in this Agreement or pursuant to applicable law.

INTELLECTUAL PROPERTY RIGHTS

26.1 All rights, title and interest in and to any software (including without limitation the App, the Website, the API, developer tools, sample source code, and code libraries), data, materials, content and printed and electronic documentation (including any specifications and integration guides) developed, provided or made available by us or our affiliates to you, including content of the Website, and any and all technology and any content created or derived from any of the foregoing (“AYABANK Materials”) and our Services are the exclusive property of AYABANK and its licensors. The AYABANK Materials and Services are protected by intellectual property rights laws and treaties around the world. All such rights are reserved.

26.2 How you can use AYABANK Materials. You may only use the AYABANK Materials if you have received written permission from us. Any use of the AYABANK Materials and Services not specifically permitted by us or under this Agreement is strictly prohibited. The licences granted by AYABANK terminate if you do not comply with this Agreement or any other service terms.

26.3 When you cannot use AYABANK Materials. Unless you have received written permission from us, you may not, and may not attempt to, directly or indirectly:

26.4 AYABANK Trademarks. This is a non-exhaustive list of AYABANK Trademarks : “AYABANK”, “AYABANK CARD”, “AYABANK PLATFORM”, “AYABANKPLATFORM”, “AYABANK PAY”, “AYABANKPAY”, “AYABANKBUSINESS”, “AYABANK BUSINESS”, “AYABANKTRANSFER’, “AYABANK TRANSFER”, “TRANSFERAYABANK”, “BORDERLESS”, “MONEY WITHOUT BORDERS” and any other business and service names, logos, signs, graphics, page headers, button icons and/or scripts (each as might be amended from time to time) are all registered or unregistered trademarks or trade dress of AYABANK or AYABANK’s licensors in the relevant jurisdictions (“AYABANK Trademarks”).

26.5 You may not copy, imitate, modify, or use AYABANK Trademarks without our prior written consent. You may use HTML logos provided by us for the purpose of directing web traffic to the Services. You may not alter, modify, or change these HTML logos in any way, use them in a manner that mischaracterizes AYABANK or the Services or display them in any manner that implies AYABANK’s sponsorship or endorsement. Further, you may not use AYABANK Trademarks and trade dress in connection with any product or service that is not AYABANK’s, in any manner that is likely to cause confusion among customers, or in any manner that disparages or discredits AYABANK.

26.6 All other trademarks, registered trademarks, product names and company names or logos not owned by AYABANK that appear in AYABANK Materials or in the Services are or may be the property of their respective owners, who may or may not be affiliated with, connected to, or sponsored by AYABANK, and may not be used without permission of the applicable rights holder.

27.1 The App is subject to this Agreement and the App Store and Google Play Rules. We licence the use of the App to you on the basis of this Agreement and subject to any rules and policies applied by any app store provider or operator whose sites are located at the App Store and on Google Play. We do not sell the App to you. We always remain the owners of the App.

27.2 App updates. From time-to-time updates to the App may be issued through App Store or Google Play. Depending on the update, you may not be able to use our Services via the App until you have downloaded the latest version of the App and accepted any new terms.

27.3 Your right to use the App. In consideration of you agreeing to abide by the terms of this Agreement, we grant you a non-transferable, non-exclusive licence to use the App on your device subject to this Agreement. We reserve all other rights.

27.4 App Store terms. The following provisions apply with respect to your use of any version of the App compatible with the iOS operating system of Apple Inc. (“Apple”):

28.1 Certain Website, App or API functionality may contain or provide you access to information, products, services, and other materials by third parties (“Third Party Materials”) or allow for the routing or transmission of such Third-Party Materials, including via links.

28.2 We neither control nor endorse, nor are we responsible for, any Third-Party Materials, including the accuracy, validity, timeliness, completeness, reliability, integrity, quality, legality, usefulness or safety of Third-Party Materials, or any intellectual property rights therein. Certain Third-Party Materials may, among other things, be inaccurate, misleading, or deceptive. Nothing in this Agreement shall be deemed to be a representation or warranty by us with respect to any Third-Party Materials. We have no obligation to monitor Third Party Materials, and we may block or disable access to any Third-Party Materials (in whole or part) through the Website, App or API at any time. In addition, the availability of any Third-Party Materials through the Website, App or API does not imply our endorsement of, or our affiliation with, any provider of such Third-Party Materials, nor does such availability create any legal relationship between you and any such provider.

28.3 Your use of Third-Party Materials is at your own risk and is subject to any additional terms, conditions, and policies applicable to such Third-Party Materials (such as terms of service or privacy policies of the providers of such Third-Party Materials).

OTHER LEGAL TERMS

29.1 Unforeseeable loss or damage. We are not responsible for any loss or damage that is not foreseeable. Loss or damage is foreseeable if either it is obvious that it will happen or if, at the time the contract was made, both we and you knew it might happen, for example, if you discussed it with us during your sign-up process.

29.2 We do not exclude or limit in any way our liability to you where it would be unlawful to do so. This includes liability for death or personal injury caused by our negligence or the negligence of our employees, agents, or subcontractors, for fraud or fraudulent misrepresentation.

29.3 We are not liable for business losses. To the extent permissible by law, if you use our Services for any commercial or business purpose we will have no liability to you for any loss of profit, loss of business, business interruption, loss of business opportunity or similar.

29.4 We are not liable for technological attacks. We will not be liable for any loss or damage caused by a virus, or other technological issues or attacks or harmful material that may infect your computer equipment, computer programmes, data or other proprietary material related to your use of our Services.

29.5 We have no control over websites linked to and from our Website. We assume no responsibility for such Third-Party Materials or any loss or damage that may arise from your use of them.

29.6 Our liability to you for unauthorized payments. In case of an unauthorized payment, we shall at your request refund the payment amount including all fees deducted by us. We may require proof that such payments were unauthorized. This shall not apply where we believe:

29.7 You are responsible for checking your AYABANK Account or profile regularly. We rely on you to regularly check the transactions history of your AYABANK Account or profile and to contact Customer Support immediately in case you have any questions or concerns.

29.8 We are not liable for certain losses. You are solely responsible for losses arising from your gross negligence or fraud. We also will not be liable in the following instances:

29.9 We are not liable for things which are outside of our control. We (and our affiliates) cannot be liable for our inability to deliver or delay because of things which are outside our control.

29.10 You are liable if you breach this Agreement or applicable laws. In the event of loss, claims, costs, or expenses (including reasonable legal fees) arising out of your breach of this Agreement, any applicable law or regulation and/or your, or any Authorized User’s use of our Services, you agree to defend, compensate us and our affiliates and hold us harmless. This provision will continue after our relationship ends.

29.11 What happens if you owe us money. In the event you are liable for any amounts owed to us for whatever reason, we may immediately deduct such amounts from your AYABANK Account (if available). If there are insufficient funds in your AYABANK Account to cover your liability or you do not have a AYABANK Account, you agree to repay the outstanding amount to us immediately on demand along with any applicable fees and interest (daily late penalty for any outstanding amount is 5%). If you do not repay the outstanding amount, then, without prejudice to any other rights we may have, including the right to close your AYABANK Account under section 8, we reserve the right to collect your debt to us by using any payments received for our Services in the future (such as to fund a Money Transfer or your AYABANK Account), and otherwise you agree to reimburse us through other means. We may also recover amounts you owe us through other collection avenues, including, without limitation, using a debt collection agency or at our sole discretion bring a claim against you, notwithstanding section 32.6, in any jurisdiction where you reside or hold assets. We may recover all reasonable costs, interest, or expenses (including reasonable attorneys’ fees and expenses) incurred in connection with the enforcement of this Agreement.

29.12 Release. If you have a dispute with any AYABANK Account holder or a third party that you send money to or receive money from using the Services, you release AYABANK from all claims, demands and damages (actual and consequential) of every kind and nature, known and unknown, arising out of or in any way connected with such disputes. This means that you must use caution when dealing with third parties when using our Services.

29.13 In entering this release, you expressly waive any protections (whether statutory or otherwise) that would otherwise limit the coverage of this release to include only those claims which you may know or suspect to exist in your favour at the time of agreeing to this release.

29.14 Disclaimer of Warranty. The Services are provided “As-Is” “Where Is” and “Where Available” and without any representation or warranty, whether express, implied, or statutory. AYABANK specifically disclaims any implied warranties of title, merchantability, fitness for a particular purpose and non-infringement. We disclaim all warranties with respect to the Services to the fullest extent permissible under applicable law, including the warranties of merchantability, fitness for a particular purpose, non-infringement, and title.

29.15 Availability of Services. We will try to make sure our Services are available to you when you need them. However, we do not guarantee that our Services will always be available or be uninterrupted. We may suspend, withdraw, discontinue, or change all or any part of our Service without notice. We will not be liable to you if for any reason our Services are unavailable at any time or for any period.

30.1 We may change this Agreement by giving you at least two (2) months’ prior written notice. This notice will be provided either by email or displaying a notice in the App or in our Webpage. If we do this, you can terminate this Agreement immediately by closing your AYABANK Account or profile and ceasing use of our Services during the notice period (see section “Closing you AYABANK Account or stopping your use of our Services”). If we do not hear from you during the notice period, you will be considered as having accepted the proposed changes and they will apply to you from the effective date specified on the notice.

30.2 In some instances, we may change this Agreement immediately. Notwithstanding section 33.1, changes to this Agreement which do not require two (2) months’ notice or are (1) more favourable to you; (2) required by law; (3) related to the addition of a new service, extra functionality to the existing Service; or (4) changes which neither reduce your rights nor increase your responsibilities, will come into effect immediately if they are stated in the change notice. Changes to exchange rates shall come into effect immediately without notice and you shall not have the right to object to such a change.

31.1 If you have any complaints about us or our Services.

31.2 If you are a Corporate High Risk Account Customer you will not be eligible to complain to the Financial Ombudsman Service.

32.1 No Third-Party rights. This Agreement is between you and us. Except as expressly provided in this Agreement (for example in the App Store terms), no other person shall have any rights to enforce any of its terms. Neither of us will need to get the agreement of any other person to end or make any changes to this Agreement.

32.2 Assignment. You may not transfer, assign, mortgage, charge, subcontract, declare a trust over or deal in any other manner with any or all your rights and obligations under this Agreement (including the AYABANK Account) without our prior written consent. We reserve the right to transfer, assign or novate this Agreement (including the AYABANK Account) or any right or obligation under this Agreement at any time without your consent. This does not affect your rights to close your AYABANK Account under section 7.

32.3 Severability. Each of the paragraphs of this Agreement operates separately. If any court or relevant authority decides that any of them are unlawful or unenforceable, the remaining paragraphs will remain in full force and effect.

32.4 Enforcement. Even if we delay in enforcing this Agreement, we can still enforce it later. If we delay in asking you to do certain things or taking certain action, it will not prevent us from taking steps against you at a later date.

32.5 Entire Agreement. This Agreement supersedes and extinguishes all previous agreements between you and AYABANK, whether written or oral, relating to its subject matter.

32.6 Governing law. This Agreement is governed by English law. Any dispute between you and us in connection with the Services and/or this Agreement may be brought in the courts of England and Wales only subject to section 29.11

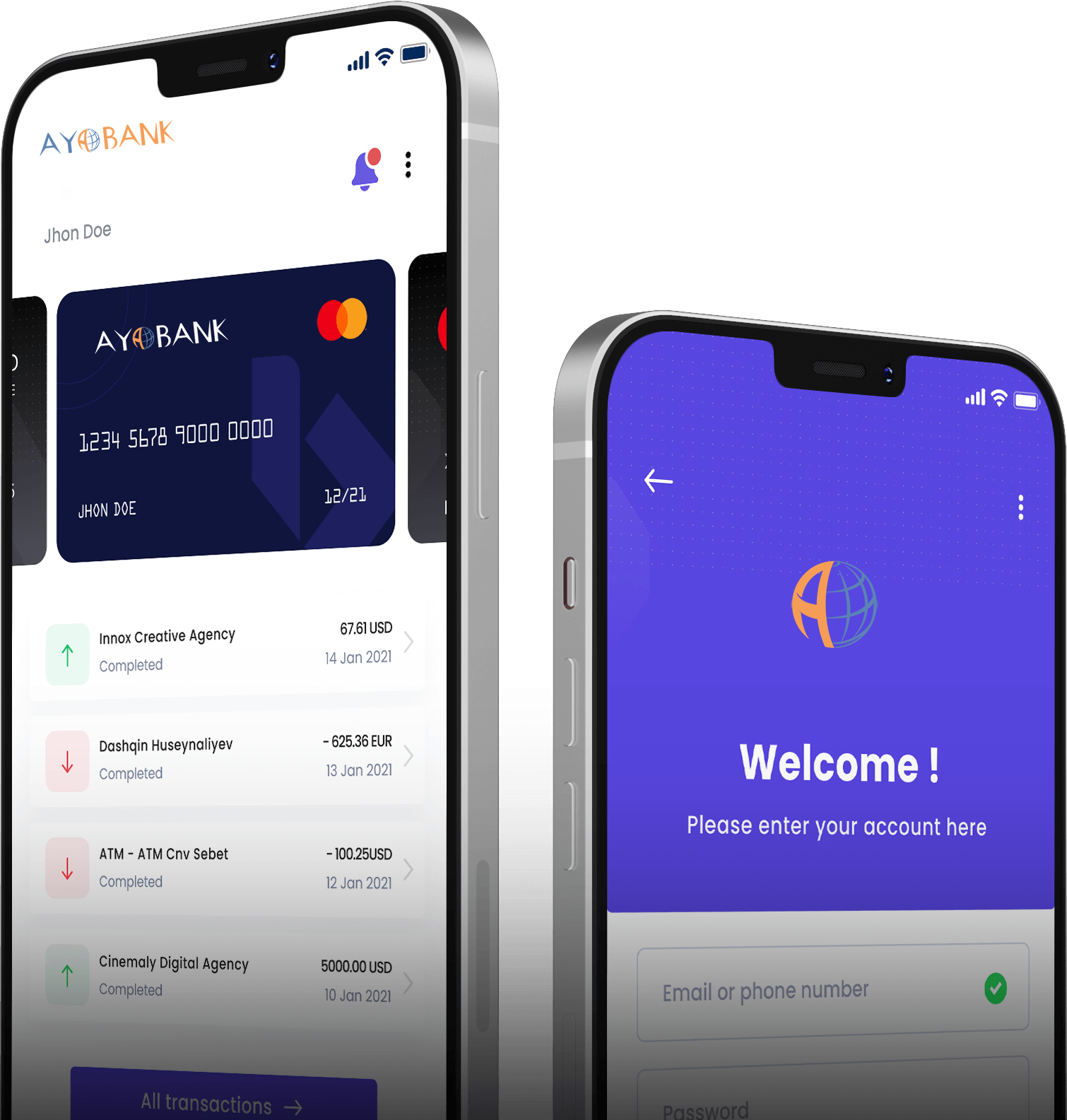

With just a few steps and clicks you can join our bank and open an individual or corporate account with a lot of features and a professional financial services team.

AYAINVEST Limited. is registered in United Kingdom under company house under Reg# (11516853) Nature of business (SIC) 64191 – 64205 – 64301 – 66300.

AYA BANK is licensed in the United States of America from the State of Alaska under License No. 2136134.

Social Chat is free, download and try it now here!